Make sure you are playing with a formal application from your economic establishment to deposit a good cheque electronically. By doing so, debt advice won’t be stored on your own smart phone. Deposit checksD easily with mobile financial as opposed to likely to an excellent department otherwise Automatic teller machine. Joining automatic alerts often let you know when an immediate deposit comes in your account. Favor the manner in which you want to discover notification — email address, text message, or push notice to your cell phone. Come across services financial degree designed to assist moms and dads and college students during the Scholar Cardio.

Play online black jack 21 | Step-by-Step Self-help guide to Using Chase QuickDeposit

Of numerous financial institutions highly recommend staying they to own a certain period of time; other financial institutions highly recommend shredding the newest take a look at the moment it’s got cleared. See your bank’s website to see what the recommendation are. The essential difference between “Depositor” and you may “Recorded by” simply applies to put account with a reliable Affiliate indexed. For these deals, the key membership holder’s name is displayed because the “Depositor” and the Respected Affiliate try displayed because the “Filed from the.” “Chase Individual Consumer” is the brand name to possess a financial and financing equipment and services giving, requiring an excellent Chase Individual Client Checking℠ account.

Checking

Very first People cannot charge costs in order to download or make use of the app on the mobile or pill. Consider the brand new Electronic Banking Commission Plan to find out more. Your own cellular service provider can charge your to own research and you can text utilize. The highly rated mobile financial application will give you the full view of the cash and you may command over your cards and you can accounts, the on the agenda.

You’ll find important differences between play online black jack 21 broker and you can investment advisory functions, such as the kind of information and you may advice considering, the new charges recharged, as well as the legal rights and you will financial obligation of your parties. You should comprehend the distinctions, especially if determining which provider otherwise services to pick. For more information in the these types of services in addition to their variations, speak with your own Merrill economic advisor.

Just what are Mobile View Deposit Limitations on the top You.S. Banking institutions?

Essentially, there is no more payment for using mobile take a look at deposit functions beyond one usual cordless supplier fees. Running moments vary from the financial, but finance are generally offered possibly the same day or perhaps the second working day. If your newest account doesn’t render this particular feature, it could be really worth researching examining membership to locate the one that boasts mobile consider deposit or any other helpful electronic financial features. You could potentially ask yourself who is able to have access to the new sensitive and painful suggestions shown to the a check, however, look at photographs aren’t stored on the mobile phone.

- Depositing money on the safer web site is actually quick, safe and easy.

- If you utilize a mobile device to view Electronic Financial, for example with the Earliest Owners application in your smartphone, which is titled mobile financial.

- Otherwise, you can check your bank account contract or speak to your lender to inquire about restrictions to possess mobile consider put.

- And something well-known ability—mobile look at put—allows people to help you put inspections through the bank’s app from the absolute comfort of house.

- In addition to, find out about the average ways fraudsters are employing to stay one-step ahead of him or her.

You are accountable for all of the can cost you of using this service membership and you can working the newest Bring Unit, as well as, although not limited by mobile and you can online sites fees. You are accountable for maintaining the brand new bodies ability and you will associations expected for use of one’s Services. Financial and you may Merrill may use no less than one third party business concerning the providing the Services and you will get together the fresh take a look at photographs. Neither Bank nor Merrill is a plant out of resources otherwise application. “Item” is actually an original view, cashier’s view, authoritative view, You.S.

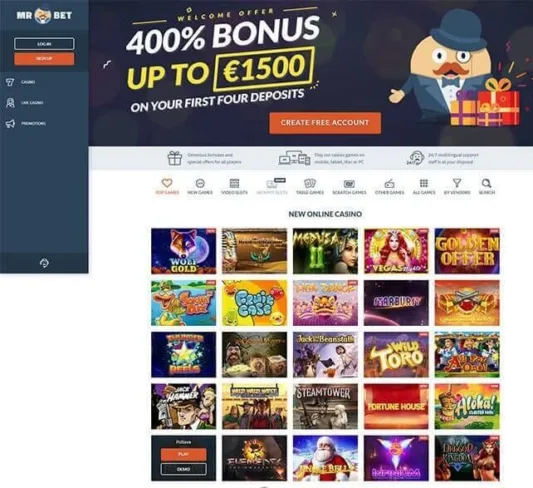

The new look at may also be returned if the truth be told there’s any difficulty to the mobile deposit, such as in case your captured pictures are illegible or perhaps the take a look at are missing an affirmation. Select from team checking, business credit cards, supplier functions otherwise go to our very own organization investment center. Of several banking companies give cellular take a look at deposit, along with Ally Financial, Bank out of America, Funding One, Pursue, Citibank, Come across, PNC Lender, U.S. Financial, and Wells Fargo. Quite often, the huge benefits usually surpass the fresh drawbacks from mobile consider places. Yet not, specific gambling enterprises can get lay limits about what fee steps be eligible for a specific extra, that is, unfortuitously, the case with Skrill and you will Neteller possibly. Be sure to see the conditions and terms out of incentives ahead of your attempt to claim him or her.

Countless Us citizens on a regular basis play with cellular banking, including the capacity to put checks having a mobile device. Deposit monitors which have a smart device, a pill, or some other smart phone is quick, easy, secure, and smoother—and you will does away with must go to a part or Atm. As well as, your money is usually offered inside a couple of working days.